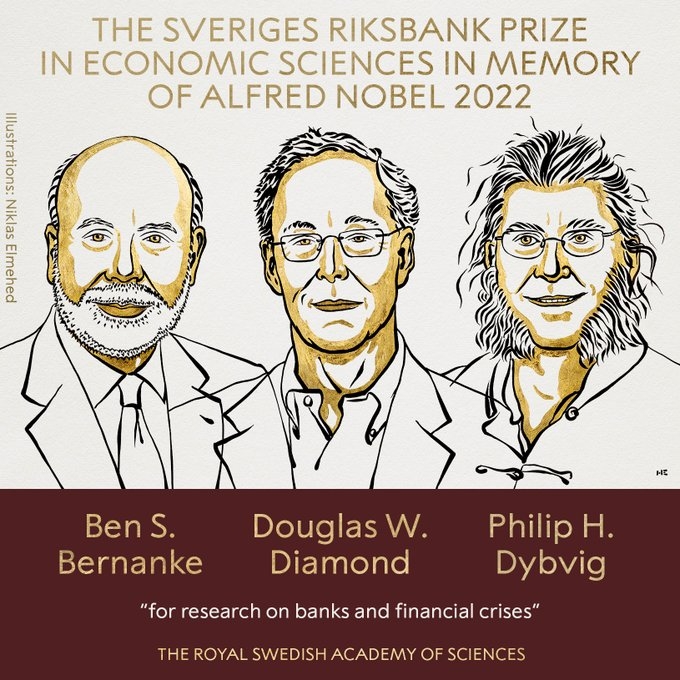

Former Fed chairman, Ben Bernanke among 3 economists to receive the Nobel Prize

Total Views |

Washington D.C., Oct 11: Three American economists, Ben Bernanke, Douglas Diamond, and Philip Dybvig, who are currently associated with The Brookings Institution, University of Chicago, and Washington University, respectively, have been awarded this year’s Nobel Prize in economic sciences in recognition of their work on the persisting challenge of how to regulate financial institutions.

The Committee cited a 1983 paper by Bernanke, the chairman of the Federal Reserve between 2006 and 2014, that analyzed the Great Depression of the 1930s to show that the crisis of banks can be the cause rather than a consequence of a long-drawn economic crisis. Diamond and Dvybig have been awarded for their explanation of the larger role of banks in the functioning of a modern economy by intermediating a conflict between the basic aspirations of depositors and borrowers.

While the former would always like instant liquidity, the latter want access to long-term finance. It is exactly this role that makes banks vulnerable to a crisis such as a bank run as even a rumor of a shortage of liquidity in a bank can lead to all depositors wanting to withdraw money, triggering an actual shortage of funds. The way to prevent such a crisis is twofold, Diamond and Dvybig argued, first through a sovereign guarantee for a bank and second through making sure that banks monitor their borrowers closely.

The award citation recognizes that the challenge of regulating financial institutions is far from over. “Research cannot provide final answers for how the financial system should be regulated. Deposit insurance does not always work as intended; it may encourage banks to engage in risky speculation where the taxpayers will foot the bill when it goes badly.

The need to save the banking system during crises can also lead to unacceptable profits for the banks’ owners and employees”, the press release said, perhaps reminiscing the turn of events during the 2008 global financial crisis, which was set up by the collapse of some US financial institutions.