RBI hikes repo rate by 50 points

08 Jun 2022 12:54:00

New Delhi, Jun 8: The Reserve Bank of India's monetary policy committee (MPC) hiked the repo rate, the key policy rate at which the central bank lends short-term funds to banks, by another 50 basis points on June 8, continuing the fight against high inflation.

With this 50-bps change, the repo rate stands at 4.9 percent.

The MPC has predicted inflation at 6.7 percent. Data released on May 12 showed retail inflation jumped to a near-eight-year high of 7.79 percent in April from 6.95 percent in March. Not only is the latest Consumer Price Index (CPI) inflation print well above the upper bound of the RBI's 2-6 percent tolerance band, it is the 31st consecutive month in which it had come in above the medium-term target of 4 percent. The latest inflation print confirms the Monetary Policy Committee’s assessment that persistently high inflation is the biggest worry for policymakers at the moment. The MPC has a mandate to contain inflation within the 2-6 percent band and a breach for three consecutive quarters will require the panel to explain to Parliament why it failed to keep inflation within the band. On May 4, in an unscheduled announcement, the RBI had hiked the repo rate by 40 bps and the CRR by 50 bps, embarking on a major fight against rising prices. Since then, a top MPC member and the RBI governor have hinted at further rate hikes to tame inflation.

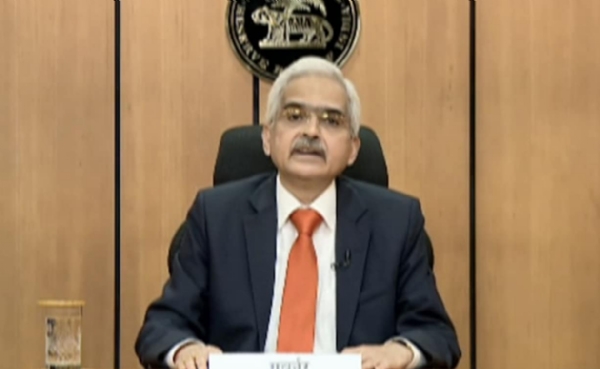

RBI Governor Shaktikanta Das had said during the out-of-turn rate hike on May 4, and also in an interview with CNBC TV 18, that another rate hike was certain. Jayanth Varma, an MPC member, had also left a clear hint on this when he said a 100-bps rate hike was likely to happen very soon. Banks have started passing on the higher rates across loan and deposit products. With today’s rate hike CHK CHK, banks are likely to further increase their lending and deposit rates to end consumers. An announcement from leading banks to this effect is likely soon.