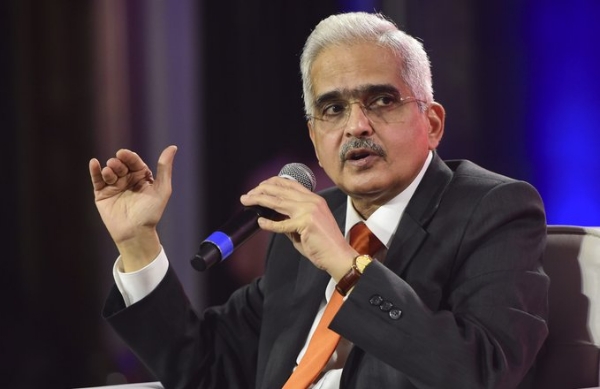

RBI governor announces Credit card UPI linkage

23 Jul 2022 16:08:48

New Delhi, Jul 23: The National Payments Corporation of India, or NPCI, which is the retail payments entity of the country, expects to implement the linking of credit cards to the unified payments interface (UPI) network, the organization’s chief executive Dilip Asbe has said. This comes over a month after Reserve Bank of India governor Shaktikanta Das announced the allowing of the linking of credit cards to UPI to facilitate payments.

“We are talking to BoB Cards, SBI Cards, Axis Bank, and Union Bank of India. We should be in a position to submit our proposal to the Reserve Bank of India (RBI) in ten days and once we get the approval, we should be able to start in two months," Asbe said at an event organized by the Bank of Baroda on Friday, July 22.

On June 8, Shaktikanta Das during his Monetary Committee Meet (MPC) announcement said that it was proposing to allow the linking of credit cards on UPI platforms. This move, was, however, expected to test the Merchant Discount Rate (MDR) benefit available to the users of UPI. As per experts, the zero-MDR benefits are one of the key reasons behind the growth of UPI and its preference among merchants instead of using cards. On credit cards, banks and payment service providers divide the amount paid by the merchant for each card transaction done. This is around 2-3 percent of the total payment in the case of credit cards. “We might have to take care of the smaller merchants and protect them from the MDR while the existing credit card servicing merchants can continue to pay," said Asbe.

RBI deputy governor T. Rabi had said in June that “going to the pricing structure is jumping the gun" and RBI “will see how it will be priced", on being asked about the difference in pricing of UPI and credit cards and how both will be synched. “Basic objective of linking credit cards to UPI is to provide customers with a wider choice of payments. Currently, UPI has linked to debit cards and savings bank accounts only, but now it will be linked to credit cards as well. We will introduce the arrangement of credit card linkage with UPI, and see how the pricing goes," he said.

As per guidelines that came into effect from January 1, 2020, UPI and RuPay attract zero-MDR — which means that there are no charges on these transactions. “At present, UPI facilitates transactions by linking savings/current accounts through users’ debit cards. It is now proposed to allow the linking of credit cards on the UPI platform. To begin with, the Rupay credit cards will be linked to the UPI platform," Shaktikanta Das said in June. This arrangement is expected to provide more avenues and convenience to the customers in making payments through the UPI platform, said the RBI in a statement.