RBI keeps repo rate unchanged at 6.5% for third time in a row

10 Aug 2023 10:38:50

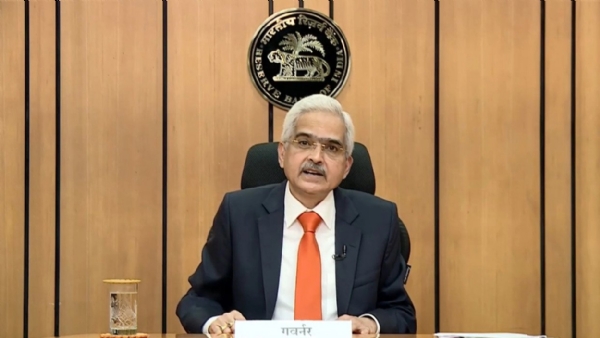

On Thursday (August 10), the Reserve Bank of India (RBI) decided to keep the repo rate unchanged at 6.50 per cent, Governor Shaktikanta Das announced presiding the Monetary Policy Committee (MPC) meeting.

RBI Governor Shaktikanta Das announced the third bi-monthly monetary policy for FY24 on Thursday. The three-day meeting of the six-member Monetary Policy Committee (MPC) of RBI was held from August 8 to 10.

"Monetary Policy Committee decided unanimously to keep the Repo Rate unchanged at 6.50 per cent," said Das, adding that the Indian economy had made significant progress towards controlling inflation. He said that the decision to keep the policy interest rate unchanged was unanimous.

This means the loan interest rates too are likely to remain unchanged. It is pertinent to mention that since May 2022, the central bank has raised the repo rate by 250 basis points (bps).

The RBI governor highlighted that monetary policy transmission is still underway, headline inflation remains higher than 4 per cent target.

Das also said that global economy continues to face daunting challenges of inflation and geo political uncertainty.

MPC will "remain watchful of inflation and remains resolute to its commitment to align inflation to the targeted level".

What is repo rate?

When commercial banks loan by selling their securities to the central bank, the RBI charges them an interest rate. This interest rate is called the repo rate in the monetary policy. Lower interest rates make it easier for individuals and businesses to borrow money to invest in new economic activities.