NB Explains | Why record credit card spendings in India is not good news?

29 Sep 2023 13:19:52

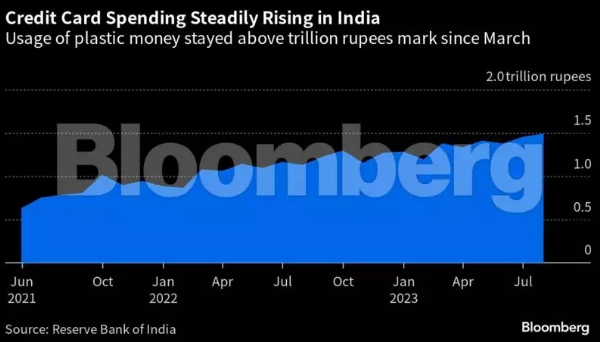

Credit card spending by Indians surged to a record high, raising concerns of potential defaults as indebted households stepped up their borrowing spree ahead of the festive season that kicked off this month.

What happened?

The amount transacted through credit cards rose to an all-time high of 1.48 trillion rupees ($17.8 billion) in August, up from July’s 1.45 trillion rupees, according to the latest data by the Reserve Bank of India.

The spending binge is in line with rising indebtedness and falling savings among Indians and may point to growing stress as incomes stagnate.

What does it indicate?

The rising spending points to an aggressive retail push by lenders in the under-banked market with a 1.4-billion population.

Post pandemic, banks have expanded their balance sheet mainly by funding individuals, while credit demand from businesses has somewhat lagged.

RBI raises concerns

"People are borrowing money to spend"

The RBI has raised concerns over this rise in unsecured lending on financial stability. In addition to this, the RBI has highlighted concerns over the growing risk of delinquencies on unsecured loans amidst high-interest rates and high inflation.

Rising debts

The net financial savings of households plunged by close to 55% in FY23 to 5.1% of GDP, and their indebtedness more than doubled to Rs 15.6 lakh crore from FY21, primarily led by massive borrowings from banks.

India not alone

The US and the UK - both witnessing very high inflation - too are facing a similar situation with credit card spending. Both of them hit record high between March and August. Around a month ago, credit card debt levels in the US touched $1 trillion.